After what turned out to be a year like no other, back in December 2020 we challenged ourselves to try and predict what 2021 had in store for business owners, introducers, employees, and lenders when we revealed our 12 predictions for this year. With the second half of the year already well underway, we are revisiting those predictions to see whether we’re on the right track with them – read on to see how we’re progressing!

PREDICTION 1 – Access to cashflow will be vital for success – Josh Levy, CEO

What we said: “Going into next year, SMEs face being unable to access primary or traditional sources of working capital funding, whether that’s loans or overdrafts. This is where specialist lenders and asset-based lenders can be such a great option.”

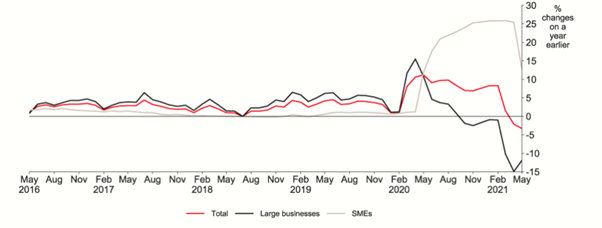

How it’s looking: Due to another lockdown at the start of 2021, CBILS was extended until the second quarter of the year to ensure businesses could still gain access to the cashflow they needed to keep their businesses running. Despite the follow up Recovery Loan scheme launching on 6th April 2021 the latest Bank of England statistics on annual growth of lending to SMEs and large businesses shows a sudden drop in lending to businesses of all sizes since the beginning of the year – a trend that has continued for all except large businesses up until at least May. Despite these findings, we were delighted to support more businesses than ever access the right funding to help them keep moving during the first 6 months this year. So we believe that into the second half of the year, this prediction could well come true.

Source: https://www.bankofengland.co.uk/statistics/money-and-credit/2021/may-2021

PREDICTION 2 – The rise of blended working – Yvonne Balfour, CMO

What we said: Our prediction is that a blended approach will flourish going forward, where a combination of home and office-based working will bring significant benefits to both employees and employers.

How it’s looking: Up until July, the government guidance has remained for employees to work from home wherever possible and we’re only now seeing a gradual return to commuting and office-based working. However, news headlines have been mostly dominated by firms announcing the adoption of a blended model indeed – latest survey results from the Office of National Statistics showed 85% of employees currently working from home expect to share their time between working at the office and working from home once restrictions ease completely. Here at Ultimate Finance, we’re piloting our own new blended ways of working after collaborating with our teams over the last few months.

PREDICTION 3 – Tailored funding requirements – Nick Haggitt, Head of Sales

What we said: We believe Invoice Finance will emerge as one of the most sought-after funding lines as more businesses turn to asset-based lending.

How it’s looking: There are encouraging signs that point towards Invoice Finance growing in demand again now the Government scheme for CBILS and BBLS have ended, and as invoicing returns to pre-March 2020 levels. Our own Invoice Finance book showed signs of encouragement by the end of July, with new business acquisition up 20% on H2 2020. And after being named Invoice Finance Lender of the Year at this year’s SME Funding Awards, we’re still confident our working capital facilities will emerge as one of the best tools on businesses’ recovery journey.

PREDICTION 4 – Driving 50% more business in 2021 through great service – Richard Hamilton, Sales Director

What we said: Based on the amazing feedback we’ve received on our service and partnership approach with brokers this year, we predict in 2021 we will drive 50% more leads through recommendations from brokers and Introducers.

How it’s looking: So far 2021 has seen our teams achieve record performance after record performance by partnering with our Ultimate Finance Introducers and providing the right funding at the right time to help businesses keep moving and meet their ambitions on their recovery journey. Over the first six months of the year, we provided £80m of new lending, 50% more than during the same period in 2020 – in Asset Finance alone we saw an increase of 63% in new lending.

PREDICTION 5 – Fraud will impact recoveries, but Open Banking will help combat new fraudsters – Polly Russell-Stower, Group General Counsel

What we said: Lenders will see a rise in recovery issues as a result of fraud but will also look to harness the benefits of Open Banking in a bid to combat fraudsters.

How it’s looking: In June it was revealed that a whooping 39,601 companies closed after being struck off the Companies House register in Q1 2021 compared to only 4,695 in the same period last year. The huge increase (743% year on year) backs up fears of a wave of fraud associated with CBILS and BBLS, with the Government proposing to grant enhanced powers to the Insolvency Service to enable it to investigate and disqualify dissolved companies’ directors.

PREDICTION 6 – The impact of COVID-19 on businesses solvency – Lawrence Wood, Group Head of Credit

What we said: the prediction is that the global COVID-19 pandemic could result in one of the largest waves of insolvency in recent times.

How it’s looking: With the government schemes been extended earlier this year and the furlough scheme still ongoing, there may still be just enough support to keep the most at risk businesses trading for now – but is it a case of delaying the inevitable? Only time will tell for now.

PREDICTION 7 – The rise of Alternative Lenders – Andrew Ribbins, Group Sales Director & Managing Director

What we said: In Q1 2020, 24 % of SMEs were either actively seeking or open to seeking funding. By the end of Q3 2020 that figure had risen to 38%. We predict this figure will continue to rise in 2021 and will be closer to 50% by the end of Q1 2021.

How it’s looking: Industry-wide figures are yet to be compiled and published but looking at our own data this year, we have experienced an undeniable increase in demand for asset-based funding lines, with March and May driving record amounts of new clients onboarded and new funding solutions provided to businesses.

PREDICTION 8 – Automating the mundane – Neil McMyn, CFO

What we said: Data and automation will help businesses identify emerging trends that require action to ultimately improve profitability.

How it’s looking: It’s hard not to see this one become reality – companies have been adopting automation and utilising more and more complex data sets for the past few years and, as predicted, the pandemic has strongly reinforced the idea of resilience, profitability and risk-adversity for most businesses.

PREDICTION 9 – Impact on the property market – Liam Cavanagh, Head of Bridging Finance

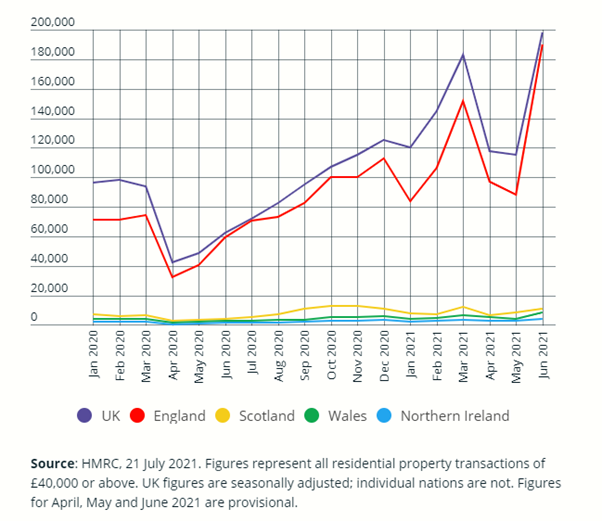

What we said: the property market will slow down somewhat on the back of the Government schemes ending, but we won’t see a huge drop in property values as property investors with access to alternative funding lines like Bridging Finance continue to seek new opportunities and drive the property market forwards.

How it’s looking: Although new property sales dipped at the end of CBILS and the stamp duty holiday scheme, figures as of May 2021 were still much higher than pre-pandemic with close to 120,000 property sales still going through, only slightly below the original peak of 2020. We broke our own Bridging Finance new business record in May with £20m worth of facilities issued.

Source: https://www.which.co.uk/news/2021/07/how-will-the-coronavirus-affect-house-prices/

PREDICTION 10 – Satisfied clients will keep businesses moving – John Lightfoot, Head of Relationship Management & Client Service

What we said: Those that have been able to support their clients through 2020 by going the extra mile will recover quicker and stronger. With face to face meetings still not expected to be back to pre 2020 levels for some time, social proof and customer advocacy could tilt the balance of new business in their favour.

How it’s looking: According to a recent study by Accenture, 62% of consumers want companies to stand up for the issues they are passionate about – and supporting each other through the pandemic and recovery phase has been number one on most people’s mind. At a time where much of our time was spent indoors facing a screen, social media and review sites such as Trustpilot have been used to praise – or denounce – brands and companies based on how they treated their existing customers over the last 18 months. This year saw us keep our industry topping score of 4.9/5 and exceed 500 reviews from clients and Introducers.

PREDICTION 11 – The rise of Open Finance – Andrew McKee, CIO

What we said: 2021 will see a growing number of lenders and clients successfully using Open Finance as the industry moves beyond the hype of a solution which promises much but is in fact used by relatively few clients so far.

How it’s looking: The latest figures from OpenBanking show an undeniable growth throughout 2020 and this year, with a 450% growth in adoption year on year in 2020. The organisation also estimates that up to 70% of this volume “relates to propositions supporting improved financial decision making” – showing the power of the technology is indeed being leveraged by lenders and borrowers.

PREDICTION 12 – The year of partnerships – Adrian Stalley, Head of Partnerships

What we said: 2021 will be a year of collaboration between like-minded businesses to achieve success (partnerships if you like!)

Did we get it right? Partnerships are at the core of our proposition at Ultimate Finance, be it with our Introducers, the business owners we’re supporting or the businesses we partner with to provide additional value to our clients. That’s why we’ve produced articles and joined webinars and virtual roundtables to talk about how the success of the recovery of UK businesses relies not just on businesses, nor just on introducers sourcing the right funding, nor just on lenders providing that very funding but on the ecosystem that pulls them all together.