From 8th December we’ll be revealing 12 predictions the Ultimate Finance team has made for 2021. After a year none of us could have seen coming, we’re challenging ourselves to guess what next year holds for businesses and employees – how many can we get right? Find out more about what our CEO Josh Levy had to say in his introductory video.

Behind each door below is one of our predictions. Click on an open door to take a peak into what the future (possibly) looks like!

THE ULTIMATE PREDICTIONS

PREDICTION 1 – Access to cashflow will be vital for success – Josh Levy, CEO

My key prediction for 2021 concerns liquidity and specifically that access to liquidity will be a serious problem for SMEs. Cashflow and overall business liquidity is a challenge for all companies. The various Government support schemes – loans, grants and tax deferrals – have helped overcome the COVID pandemic related impact of reduced income and pressured cashflows. But going into next year, SMEs face being unable to access primary or traditional sources of working capital funding, whether that’s loans or overdrafts. This is where specialist lenders and asset-based lenders can be such a great option.

But the key is that liquidity is always there until it is needed most, and the value of liquidity cannot be understated. Liquidity enables businesses to trade through uncertainty and capitalise on opportunities for growth. Thus, access to capital, closely watched working capital management and strong credit control will be key ingredients for success next year and beyond, particularly in an uncertain trading environment. Don’t assume that just because liquidity is there today that it will be there tomorrow.

PREDICTION 2 – The rise of blended working – Yvonne Balfour, CMO

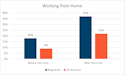

Taking the positives from the demand for work from home that COVID brought this year, our prediction is that a blended approach will flourish going forward, where a combination of home and office based working will bring significant benefits to both employees and employers, with a doubling in the numbers able to achieve this balance (from 18% to 40%).

‘Blended working’ is a new expression that describes a mix of working at home and working in the office. It’s another way of describing flexible working.

2021 will be the year that business owners look to support their business aspirations with more flexible funding solutions that are tailored to their needs. We believe Invoice Finance will emerge as one of the most sought after funding line as more businesses turn to asset based lending.

PREDICTION 4 – Driving 50% more business in 2021 through great service – Richard Hamilton, Sales Director

Based on the amazing feedback we’ve received on our service and partnership approach with brokers this year, we predict in 2021 we will drive 50% more leads through recommendations from Introducers.

PREDICTION 5 – Fraud will impact recoveries, but Open Banking will help combat new fraudsters – Polly Russell-Stower, Group General CounselLenders will see a rise in recovery issues as a result of fraud, particularly in relation to the Bounce Back Loan Scheme and situations where a borrower may have managed to obtain both a Bounce Back Loan and a CBILS loan (which is against the scheme rules).

Lenders will also look to harness the benefits of Open Banking in a bid to see them combat fraud. This will have particular benefit to working capital providers, as they will be able to enhance the level of due diligence on clients cashflow and also make the clients’ onboarding experience easier and quicker.

PREDICTION 6 – The impact of COVID-19 on businesses – Lawrence Wood, Group Head of Credit

With continued economic uncertainty, the prediction is that the global COVID-19 pandemic could result in one of the largest waves of insolvency in recent times. Despite the Government support initiatives there will be an unquantifiable high number of businesses entering some form of insolvency during 2021. For many of these businesses that were pre-Covid both profitable and viably successful the sensible option will be to consider a pre-pack administration or Company Voluntary Arrangement (CVA) to which we expect to see a record number coming through next year.

Many previously robust and well performing businesses are now fighting to survive and with a gloomy economic outlook, all parties need to cooperate; the struggling SME itself, creditors, Government, the Banks…..all have a part to play and must be open in approach and view.

Here at Ultimate Finance we have set out an approach for such proposals that ensures all stakeholders are considered – Directors, business employees and/or creditors – and we make sure appointed advisors honour the conduct of transparency for all. Working with us, we can support the advisors and business owners in considering pre-pack administration with corporate finance restructuring.

PREDICTION 7 – The rise of Alternative Lenders – Andrew Ribbins, Group Sales Director & Managing Director

Having worked through three recessions, I have witnessed on each occasion the High Street Banks retrench and withdraw (to an extent) from lending to SME’s. This has been led by the tightening of their own lending criteria and the deterioration of prospects’ Balance Sheets.

The net result has been and I predict will be again this time, a trickle down effect, with borrowers looking to Alternative Lenders to fill the void.

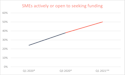

In Q1 2020, 24 % of SMEs were either actively seeking or open to seeking funding. By the end of Q3 2020 that figure had risen to 38%. We predict this figure will continue to rise in 2021 and will be closer to 50% by the end of Q1 2021.

PREDICTION 8 – Automating the mundane – Neil McMyn, CFOWatch our CFO Neil McMyn explain how data and automation will help businesses identify emerging trends that require action to ultimately improve profitability.

PREDICTION 9 – Impact on the property market – Liam Cavanagh, Head of Bridging Finance

We’ve seen the property market outperform the negative predictions set out earlier in the year – this has largely been down to government schemes and a pent up demand going into lockdown.

I predict that the property market will slow down somewhat on the back of these schemes ending, but we won’t see a huge drop in property values as property investors which access to alternative funding lines like Bridging Finance continue to seek new opportunities and drive the property market forwards.

PREDICTION 10 – Satisfied clients will keep businesses moving – John Lightfoot, Head of Relationship Management & Client Service

Those that have been able to support their clients through 2020 by going the extra mile will recover quicker and stronger. With face to face meetings still not expected to be back to pre 2020 levels for some time social proof and customer advocacy could tilt the balance of new business in their favour – see how John believes businesses can use great experiences to help keep businesses moving:

PREDICTION 11 – The rise of Open Finance – Andrew McKee, CIO

2021 will see a growing number of lenders and clients successfully using Open Finance as the industry moves beyond the hype of a solution which promises much but is in fact used by relatively few clients so far.

At Ultimate Finance we aim to have 70% of our clients sharing open finance data with us by the end of 2021 through our technology partners, helping us deliver faster decisions and increased support for our clients.

PREDICTION 12 – The year of partnerships – Adrian Stalley, Head of Partnerships

2021 will be a year of collaboration between like-minded businesses to achieve success (partnerships if you like!)

Know what your business is good at and focus on doing it the best you can. If 2020 has taught us anything it is this. With restrictions ever changing there is so much outside of a business owners’ control. It therefore becomes more important than ever to be able to focus on “your bit in the chain” and ensure that can flex according.

Those businesses who choose to spread the burden and worry by engaging with others, forming partnerships to come together to deliver success, will be those that flourish. So ask yourself, how confident are you of others in your supply chain?

Building meaningful personal relationships with your business suppliers in 2021 will allow you to discuss changing needs, react quicker, and more importantly sleep better! The COVID challenges will be here for some time and by investing time to build personal relationships with like-minded suppliers your business will be too.